Corporate Governance

- HOME

- IR Information

- Corporate Governance

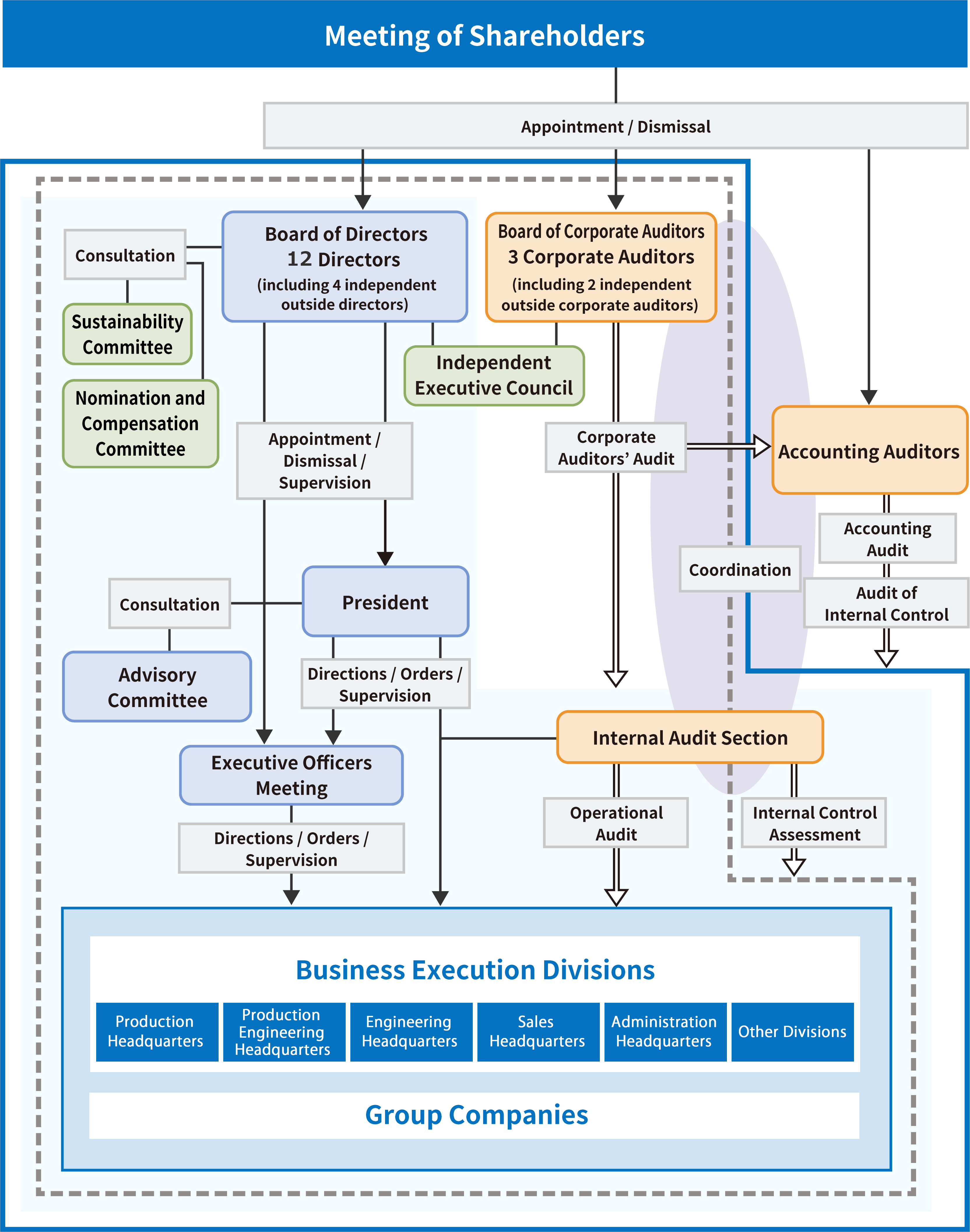

Corporate Governance Structure

Advisory body of the Board of Directors

1. Nomination and Compensation Committee

The Nomination and Compensation Committee has been established to strengthen the fairness, transparency, and objectivity of procedures related to the nomination and compensation of directors.

The Nomination and Compensation Committee is composed of a majority of independent outside directors, and the chairperson of the committee is selected from among the members who are independent outside directors.

Members of the Nomination and Compensation Committee

| Chairperson | Independent Outside Director | Masanobu Kaizu |

|---|---|---|

| Member | Independent Outside Director | Toshiharu Kagawa |

| Member | President | Yoshiki Takada |

2. Sustainability Committee

The Sustainability Committee has been established to oversee the Company's sustainability efforts.

The composition and chairperson of the committee are the same as those of the Nomination and Compensation Committee.

Members of Sustainability Committee

| Chairperson | Independent Outside Director | Kyoichi Miyazaki |

|---|---|---|

| Member | Independent Outside Director | Yoshiko Iwata |

| Member | President | Yoshiki Takada |

3. Executive Officers Meeting

In order to speed up the sharing of information, we have established the Executive Officers Meeting, which is composed of directors and executive officers who perform duties.

4. Advisory Committee

The Advisory Committee has been established as an advisory body to the President, with the presidents of the Company and four major subsidiaries (China, Singapore, the U.S., and Italy) as members, to create a system that can substitute for the decision-making function regarding the Group's business execution in the event of an emergency.

Independent Executive Council and Lead Independent Director

Independent Executive Council, consisting solely of outside directors and outside corporate auditors, has been established for the free and vigorous exchange of opinions, information and shared awareness, and to make recommendations to the Board of Directors after collecting opinions as necessary.

In addition, the "Lead Independent Outside Director" is elected by the Outside Directors to facilitate communication and coordination between the Outside Directors and the Board of Directors, the Board of Corporate Auditors, and the business execution divisions, etc., and to facilitate dialogue with investors.

Board Members

President

-

Yoshiki Takada

Yoshiki TakadaAssignment of work and important concurrent position at other organization

- Senior General Manager of Sales Headquarters

- Chairman, SMC US

- (Member of the Nomination and Compensation Committee)

- (Member of the Sustainability Committee)

Director and Managing Executive Officer

-

Yoshitada Doi

Yoshitada DoiAssignment of work and important concurrent position at other organization

- Senior General Manager of Engineering Headquarters

Director and Executive Officer

-

Masahiro Ota

Masahiro OtaAssignment of work and important concurrent position at other organization

- General Manager of Finance and Accounting Division

-

Samuel Neff

Samuel NeffAssignment of work and important concurrent position at other organization

- In charge of Supply Chain Management/General Manager of Integrated SCM Division

-

Koji Ogura

Koji OguraAssignment of work and important concurrent position at other organization

- Vice Senior General Manager of Sales Headquarters

-

Kelley Stacy

Kelley StacyAssignment of work and important concurrent position at other organization

- In charge of GHR/In charge of GIT

- (President of SMC U.S.)

-

Hidemi Hojo

Hidemi HojoAssignment of work and important concurrent position at other organization

- Senior General Manager of Production Headquarters

Director

-

Toshio Isoe

Toshio IsoeAssignment of work and important concurrent position at other organization

Outside Directors

-

Masanobu KaizuIndependentOutside

Masanobu KaizuIndependentOutsideAssignment of work and important concurrent position at other organization

- (Lead Outside director of the Company)

- (Chairman of the Nomination and Compensation Committee)

-

Toshiharu KagawaIndependentOutside

Toshiharu KagawaIndependentOutsideAssignment of work and important concurrent position at other organization

- (Member of the Nomination and Compensation Committee)

- Professor Emeritus at Tokyo Institute of Technology

-

Yoshiko IwataIndependentOutside

Yoshiko IwataIndependentOutsideAssignment of work and important concurrent position at other organization

- (Member of the Sustainability Committee)

- Chairperson, Member of the Board of J-Eurus IR Co., Ltd.

- Outside Director, Lasertec Corporation

-

Kyoichi MiyazakiIndependentOutside

Kyoichi MiyazakiIndependentOutsideAssignment of work and important concurrent position at other organization

- (Chairman of the Sustainability Committee)

- Representative Director of Zen Asset Management Co., Ltd.

Corporate Auditor

-

Takemasa Chiba

Takemasa Chiba

Outside Corporate Auditors

-

Arata ToyoshiIndependentOutside

Arata ToyoshiIndependentOutsideImportant concurrent position at other organization

- Certified Public Accountant (Representative of CPA Toyoshi Arata Office)

-

Haruya UchikawaIndependentOutside

Haruya UchikawaIndependentOutsideImportant concurrent position at other organization

- Lawyer (Partner, Midosuji Legal Profession Corporation)

June, 2025 Board of Directors

Criteria on independence of Outside Directors and Outside Corporate Auditors

Described below are the criteria for judging independence of Outsidel Directors and Outside Corporate Auditors. The Company has set these criteria by adding the Company’s unique essence on to those issued by the Tokyo Stock Exchange and other relevant legal requirements.

◆Any of the following items must not be applicable in the most recent fiscal year (year-end).

- A person conducting business operations of the Company’s group (e.g. Executive Director, Executive Officer or employee; hereinafter the same applies)

- A main account (*) of the Company’s group, or a person conducting business operations for the account

(*) A main account means any of the following persons or organizations.

- A customer to which the Company’s group makes 2% or more of its consolidated net sales

- A supplier or a service provider that makes 2% or more of its consolidated net sales to the Company’s group

- A lender from which the Company’s group has gotten a loan amounting to 2% or more of its consolidated total assets

- A major shareholder of the Company (who holds 10% or more of the total voting rights) or a person conducting business operations of the shareholder

- A certified public accountant or a person who belongs to an audit corporation that undertakes statutory audit work for the Company’s group

- A person who conducts business operations of a company that has interlocking Executives or Executive Officers with the Company’s group

- A professional (e.g. lawyer, certified public accountant, registered tax accountant, or consultant) who receives compensation, etc., amounting to 10 million yen or more, in addition to Director compensation, from the Company’s group (If such professional is a corporation or another organization, a person who belongs to such corporation or organization is applicable)

- An individual, organization or a person who conducts business operations for such individual or organization and receives a contribution of 100 million yen or more from the Company’s group

- A person who used to be applicable to (1) above in the past 10 years or a person who used to be applicable to any of (2) through (7) above in the past 3 years

- The spouse or a relative within the second degree of a person described in (1) through (8) above. However, a “person conducting business operations” is limited to an important person conducting such operations (i.e. Executive Director, Executive Officer, or high-ranking employee receiving the same treatment as Executive Officer)

Skills matrix for Directors and Corporate Auditors

| Position and Assignment of Work | Name | Corporate Management | Economic Analysis | Technology Development | Sales & Marketing | SCM | Finance Accounting | Legal Risk Management | IR | ESG SDGs | Internationalism |

|---|---|---|---|---|---|---|---|---|---|---|---|

| President | Yoshiki Takada | ○ | ○ | ○ | ○ | ||||||

| Director and Managing Executive Officer | Yoshitada Doi | ○ | ○ | ○ | |||||||

| Director and Executive Officer | Masahiro Ota | ○ | ○ | ○ | |||||||

| Samuel Neff | ○ | ○ | ○ | ||||||||

| Koji Ogura | ○ | ||||||||||

| Kelley Stacy | ○ | ○ | ○ | ||||||||

| Hidemi Hojo | ○ | ○ | |||||||||

| Director | Toshio Isoe | ○ | ○ | ○ | ○ | ||||||

| Outside Directors | Masanobu Kaizu | ○ | ○ | ○ | ○ | ||||||

| Toshiharu Kagawa | ○ | ||||||||||

| Yoshiko Iwata | ○ | ○ | ○ | ○ | |||||||

| Kyoichi Miyazaki | ○ | ○ | ○ | ||||||||

| Corporate Auditor | Takemasa Chiba | ○ | ○ | ||||||||

| Outside Corporate Auditors | Arata Toyoshi | ○ | |||||||||

| Haruya Uchikawa | ○ | ||||||||||

| Position and Assignment of Work | Name | Corporate Management | Economic Analysis | Technology Development | Sales & Marketing | SCM | Finance Accounting | Legal Risk Management | IR | ESG SDGs | Internationalism |

Policy regarding the determination of details of compensation payable to Directors

Resolutions at the General Meeting of Shareholders related to compensation for Directors and Corporate Auditors

Total amounts of annual monetary compensation for Directors and Corporate Auditors were determined as below.

- ・Total amounts of monetary compensation for Directors (including basic compensation and performance-linked compensation) :

no more than 900 million yen - ・Non-monetary compensation (stock compensation)

3,000 shares and no more than 300 million yen - ・Total amounts of monetary compensation for Directors :

no more than 100 million yen

Policy for determining the details of compensation for individual Directors

The policy for determining individual director compensation is established by the Board of Directors after deliberation by the Nominating and Compensation Committee as follows.

<Basic Policy>

- ・The Company’s basic policy is to ensure that the compensation of Directors functions appropriately as an incentive to achieve sustainable growth of the Company and medium- to long-term enhancement of the Company’s corporate value, and that the level of compensation is appropriate to the responsibilities of each Director.

- ・Compensation for Executive Directors shall consist of basic compensation, performance-linked compensation, and stock compensation. Non-executive Directors shall be paid only basic compensation.

<Policy for determining basic compensation>

- ・The basic compensation for Directors shall be determined by thoroughly considering the earnings forecast, employees’ salary levels, contribution of each Director to earnings, position, assignment to work and term of office and the like.

- ・The basic compensation for Executive Directors shall be determined by evaluating their individual contributions towards the achievement of the Company’s important issues (materiality) aimed at solving social problems (ESG issues, etc.).

<Policy for determining performance-linked compensation>

- ・For performance-linked compensation for Directors (excluding Outside Directors and Non-Executive Directors), the payment amount is decided by role based on the achievement of performance indicators decided by the Board of Directors meeting for each fiscal year after deliberation of the Nomination and Compensation Committee.

- ・The above performance-linked compensation is paid as a defined monetary remuneration within a range of an annual limit for monetary compensation to Directors decided by decision of the General Meeting of Shareholders.

<Policy for determining non-monetary compensation>

- ・The non-monetary compensation for Directors (excluding Outside Directors and Non-Executive Directors) shall be stock compensation (Board Benefit Trust). The details, calculation method of the number of shares, and timing of granting compensation shall be in accordance with the "Share Benefit Regulations" determined by the Board of Directors after deliberation by the Nomination and Compensation Committee.

<Policy for Determining the Ratio of Monetary and Non-monetary Compensation to Individual Compensation, etc.>

- ・The ratio of base remuneration and performance-linked compensation (monetary compensation) and stock compensation (non-monetary compensation) to individual compensation shall be determined by the Board of Directors after deliberation by the Nomination and Compensation Committee.

<Matters Relating to Determination of Individual Compensation, etc.>

- ・The Board of Directors shall determine the specific amount, timing and method of payment of compensation, etc. for each individual Director. However, the Board of Directors may, by resolution, entrust the President and Representative Director with such determination.

It is stipulated that the Board of Directors shall respect the report of the Nomination and Compensation Committee, and that the Representative Director who has been entrusted by the Board of Directors with the decision on individual compensation for each director shall report the specific amount to the Chairman of the Nomination and Compensation Committee.

Matters Relating to Performance-Linked Compensation

The performance-linked compensation for directors (excluding outside directors and non-executive directors) shall be paid in cash as a bonus in an amount determined for each position in accordance with the degree of achievement of the sales growth rate for each fiscal year relative to the results of the previous fiscal year.

The reason for selecting the sales growth rate as a performance-linked indicator is consistent with the Group’s near future goal of achieving sales of 1 trillion yen in FY2026 and its medium-term target of achieving an annual growth rate of about 10%. The bonus will not be paid in the fiscal year in which the sales growth rate becomes negative.

Matters Relating to Stock Compensation

The Company has established a "Board Benefit Trust for Directors" as a stock compensation plan for directors (excluding outside directors and non-executive directors).

The Nomination and Compensation Committee and the Board of Directors confirm that a certain level of business performance (ratio of operating income to sales) has been achieved for each fiscal year during the period covered by the trust, and then points are awarded to the eligible persons. At the time of retirement of each eligible person, the Company will pay out Company shares equivalent to the points granted and a cash payment equivalent to the market value of the Company's shares.

In the event of the dismissal of an eligible person or certain misconduct during his/her term of office, the right to receive the shares and cash benefits under this plan will not accrue, and in addition, in the event that circumstances are found that would invalidate the benefits, such as an error in the calculation of the performance figures on which the points were based, the eligible person will be obligated to return the benefits received in the past. (Mars/Clawback clause).

Total amount of Compensation for each category of directors and corporate auditors

Compensation for directors is determined by resolution of the Board of Directors, and that for corporate auditors is determined by consultation with the corporate auditors.

The total amount of compensation by type of compensation for each category of directors and corporate auditors for the fiscal year ending March 31, 2025 is as follows

| Category of directors and corporate auditors | Number of eligible directors and officers | Total Amount of Compensation, etc. (Millions of Yen) | Total amount of compensation, etc. by type (millions of yen) | ||

|---|---|---|---|---|---|

| Basic compensation | Performance-linked compensation | Stock compensation | |||

| Directors (excluding outside directors) |

8 | 506 | 332 | - | 174 |

| Corporate Auditors (excluding outside corporate auditors) |

1 | 19 | 19 | - | - |

| Outside Directors | 4 | 53 | 53 | - | - |

| Outside Corporate Auditors | 2 | 19 | 19 | - | - |

Audit Structure

Audit by Corporate Auditors

The Board of Corporate Auditors consists of one full-time corporate auditor and two outside corporate auditors.

Corporate auditors audit the legality and appropriateness of business execution by directors by attending meetings of the Board of Directors and other important meetings, and by hearing reports from directors, employees, and the accounting auditor.

We have full-time corporate auditor staff to assist the corporate auditors and ensure independence in terms of personnel.

Internal Audits

The Internal Audit Office is in charge of internal audits to audit the appropriateness of business execution by directors and employees, as well as evaluating the effectiveness of internal control over financial reporting.

The Internal Audit Office reports regularly to the Board of Corporate Auditors and the Board of Directors on the status of audit implementation, and also works closely with the accounting auditors.

Accountant Audit

- ・Name of auditing firm:Ernst & Young ShinNihon LLC.

- ・Designated and Engagement Partner Hirofumi Harashina, Mamoru Wakino, Yuki Hashimoto

- ・5 certified public accountants and 30 other assistants

- ・Audit Fees

| Classification | Compensation to Ernst & Young ShinNihon LLC. | Compensation to audit firms belonging to the same network (Ernst & Young) as Ernst & Young ShinNihon LLC. | ||

|---|---|---|---|---|

| Compensation based on audit attestation services | Compensation for non-audit certification services | Compensation based on audit attestation services | Compensation for non-audit certification services | |

| The company | 89 | - | - | 30 |

| Consolidated subsidiaries | 15 | - | 94 | 19 |

| Total | 104 | - | 94 | 49 |

In addition to the above, the total amount of compensation paid by the consolidated subsidiaries to the audit firms for audit certification services is 201 million yen.